Traveling the world is a wonderful experience. But it’s important to stay safe. One way to do this is by getting global health insurance. This guide will help you understand everything you need to know about it.

What is Global Health Insurance?

Global health insurance is a type of insurance. It covers your medical expenses when you travel abroad. It ensures you get the best medical care wherever you are.

Why Do You Need Global Health Insurance?

There are many reasons to get global health insurance. Here are some key reasons:

- Medical Emergencies: You can get sick or injured anytime.

- High Medical Costs: Medical care can be expensive in other countries.

- Peace of Mind: It helps you travel without worries.

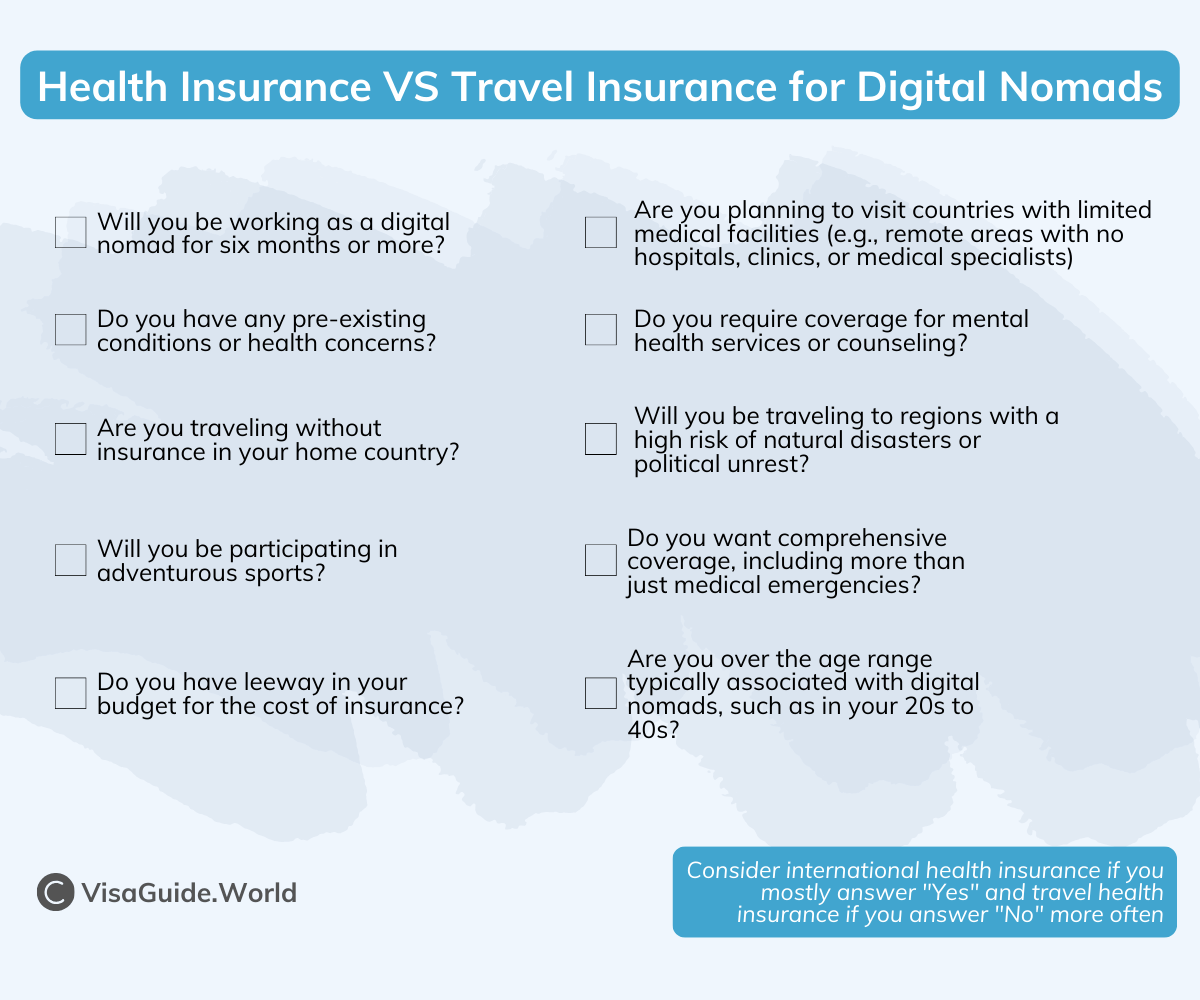

Types of Global Health Insurance Plans

There are different types of global health insurance plans. Here are the main ones:

- Travel Medical Insurance: This covers short trips.

- International Health Insurance: This is for long-term stays.

- Expat Health Insurance: This is for people living abroad.

How to Choose the Best Global Health Insurance Plan

Choosing the best global health insurance is important. Here are some tips to help you:

- Check Coverage: Make sure it covers all the countries you visit.

- Look at Limits: Check the maximum amount it will pay.

- Consider Deductibles: Know how much you must pay first.

- Read Reviews: Look for reviews from other travelers.

- Understand Exclusions: Know what is not covered.

Top Global Health Insurance Providers

There are many companies offering global health insurance. Here are some top providers:

| Provider | Special Features |

|---|---|

| Allianz Care | Wide network of hospitals, 24/7 support. |

| Cigna Global | Customizable plans, great customer service. |

| AXA | Comprehensive coverage, easy claims process. |

| IMG | Flexible plans, good for expats. |

| GeoBlue | Strong network, excellent for U.S. citizens. |

Steps to Get Global Health Insurance

Getting global health insurance is easy. Follow these steps:

- Research: Look for different plans online.

- Compare: Compare the benefits and costs.

- Apply: Fill out the application form.

- Pay: Make the payment.

- Receive: Get your insurance documents.

Credit: westcoastri.com

Credit: visaguide.world

Tips for Using Your Global Health Insurance

Here are some tips to use your global health insurance effectively:

- Carry Your ID Card: Always keep your insurance ID card with you.

- Know Your Coverage: Understand what is covered and what is not.

- Save Emergency Numbers: Keep emergency contact numbers handy.

- Contact Insurer: Call your insurer if you need medical help.

- Keep Receipts: Save all medical receipts for claims.

Common Exclusions in Global Health Insurance

Not everything is covered by global health insurance. Here are some common exclusions:

- Pre-existing Conditions: Illnesses you had before getting insurance.

- High-risk Activities: Dangerous sports and activities.

- Routine Check-ups: Regular health check-ups are often not covered.

- Cosmetic Surgery: Non-medical surgeries are excluded.

- War and Terrorism: Injuries from war or terrorism are not covered.

Frequently Asked Questions

What Is Global Health Insurance?

Global health insurance covers medical expenses internationally, ensuring you’re protected wherever you travel.

Why Is Travel Health Insurance Important?

It provides financial protection against unexpected medical emergencies while traveling abroad.

Does Global Insurance Cover Pre-existing Conditions?

Some policies cover pre-existing conditions. Check with your provider for specific details.

How To Choose The Best Travel Insurance?

Compare coverage options, costs, and customer reviews. Ensure it meets your travel needs.

Conclusion

Global health insurance is vital for any traveler. It keeps you safe and worry-free. Remember to choose the right plan and understand your coverage. Safe travels!