Planning a trip can be exciting and stressful. One way to make it easier is by using the best credit card for flight points. This can save you money and make your travel more enjoyable.

Credit: www.centralbank.net

Why Use a Credit Card for Flight Points?

Using a credit card for flight points has many benefits. You can earn points for every dollar you spend. These points can be used for free flights or upgrades. This means you can travel more without spending extra money.

Benefits Of Earning Flight Points

- Free Flights: Use points to book free flights to your dream destination.

- Upgrades: Upgrade to first class or business class using your points.

- Exclusive Offers: Get access to special deals and promotions.

- Travel Perks: Enjoy benefits like priority boarding and free checked bags.

How to Choose the Best Credit Card for Flight Points

There are many credit cards that offer flight points. Choosing the best one can be tricky. Here are some tips to help you choose the right card.

Look For High Earning Rates

Some cards offer more points per dollar spent. Look for cards that give you the most points for your spending. This will help you earn points faster.

Check The Annual Fee

Some cards have high annual fees. Make sure the benefits outweigh the cost. Sometimes, a card with a high fee can still be worth it if it offers great rewards.

Consider The Sign-up Bonus

Many cards offer a sign-up bonus. This can give you a big boost in points. Look for cards with generous sign-up bonuses.

Look For Travel Perks

Some cards offer extra travel perks. These can include free checked bags, priority boarding, and airport lounge access. These perks can make your travel experience more enjoyable.

Top Credit Cards for Flight Points

Here are some of the best credit cards for earning flight points. These cards offer great rewards and benefits for travelers.

| Credit Card | Earning Rate | Annual Fee | Sign-Up Bonus | Travel Perks |

|---|---|---|---|---|

| Chase Sapphire Preferred | 2x points on travel and dining | $95 | 60,000 points after spending $4,000 in the first 3 months | Travel insurance, no foreign transaction fees |

| American Express Gold Card | 3x points on flights booked directly with airlines | $250 | 35,000 points after spending $4,000 in the first 3 months | Airline fee credit, travel insurance |

| Capital One Venture Rewards | 2x miles on every purchase | $95 | 50,000 miles after spending $3,000 in the first 3 months | Global Entry or TSA PreCheck credit |

| Citi / AAdvantage Platinum Select | 2x miles on American Airlines purchases | $99 (waived for the first year) | 50,000 miles after spending $2,500 in the first 3 months | Free checked bag, priority boarding |

Credit: www.nerdwallet.com

How to Maximize Your Flight Points

Earning flight points is just the first step. To make the most of them, you need to use them wisely. Here are some tips to help you maximize your flight points.

Book Early

Flight prices can go up as the departure date gets closer. Use your points to book flights early. This can help you get the best value for your points.

Be Flexible

Sometimes, being flexible with your travel dates can help you save points. Check different dates to see which one requires fewer points.

Use Points For High-value Flights

Some flights offer better value for your points. Use your points for long-haul or international flights. These flights usually cost more money, so using points can save you more.

Take Advantage Of Promotions

Keep an eye out for promotions. Airlines and credit card companies often offer special deals. These can help you earn more points or use fewer points for flights.

Frequently Asked Questions

What Is The Best Credit Card For Flight Points?

The Chase Sapphire Preferred Card is highly recommended for earning flight points.

How Do Credit Card Flight Points Work?

Flight points accumulate through card purchases and can be redeemed for airline tickets.

Which Card Gives The Most Flight Points?

The American Express Platinum Card offers substantial flight points for frequent travelers.

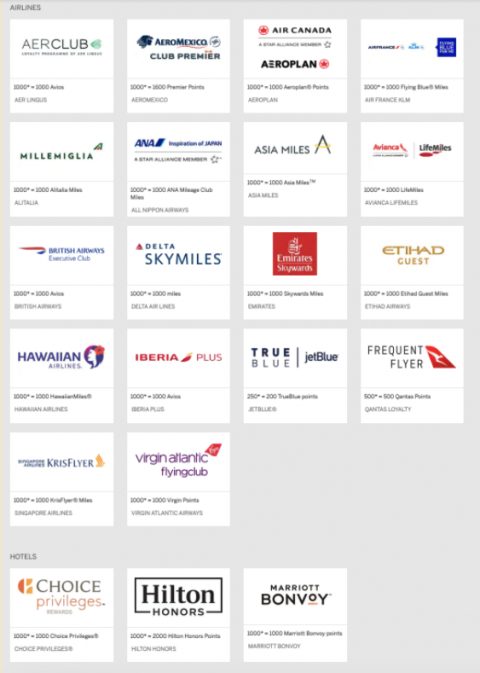

Can I Transfer Flight Points Between Airlines?

Yes, many credit cards allow transferring points to various airline loyalty programs.

Conclusion

Using the best credit card for flight points can make your travel planning easier. You can earn points for every dollar you spend. These points can be used for free flights or upgrades. This can save you money and make your travel more enjoyable.

When choosing a credit card, look for high earning rates, check the annual fee, consider the sign-up bonus, and look for travel perks. Some of the best credit cards for flight points include the Chase Sapphire Preferred, American Express Gold Card, Capital One Venture Rewards, and Citi / AAdvantage Platinum Select.

To maximize your flight points, book early, be flexible, use points for high-value flights, and take advantage of promotions. With these tips, you can make the most of your flight points and enjoy your travels.